Is Red Light Therapy HSA/FSA Eligible?

Introduction

Red Light Therapy refers to an effective method of treating various health conditions. It offers several health benefits to the users, which makes it famous among healthcare providers.

Infrared red light also raises concerns among people about managing the finances of this expensive treatment. This is when the Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) come in. These bank accounts are specially made to provide tax benefits for medical bills, which make healthcare more accessible and affordable.

This blog post by Bontanny will mostly focus on the relationship between getting Infrared red light Therapy and the financial cost of its treatment. We will also be touching on the topic of HSA and FSA eligibility by passing the criteria of the RLT. You will also get to know about the budgets of the treatment using the HSA/FSA method for the RLT. Jump with us on this voyage as we sail through the condensed relation of RLT, HSA, and FSA to better get to the financial and health departments.

Understanding Red Light Therapy

Defining Red Light Therapy And Its Operational Mechanism

Infrared light therapy uses low-level red or infrared light at specific wavelengths to provide different wellness benefits. The lights are specifically set at a certain range of wavelength which penetrates through the skin of the body and directly hits the powerhouse of the cell. The penetration triggers energy production in the body, which leads to cell repairment and regeneration. Red light therapy does not touch directly with the skin. The non-invasive feature of RLT heals the skin without reacting or damaging it.

The Broad Spectrum Of Red Light Therapy In Health And Wellness

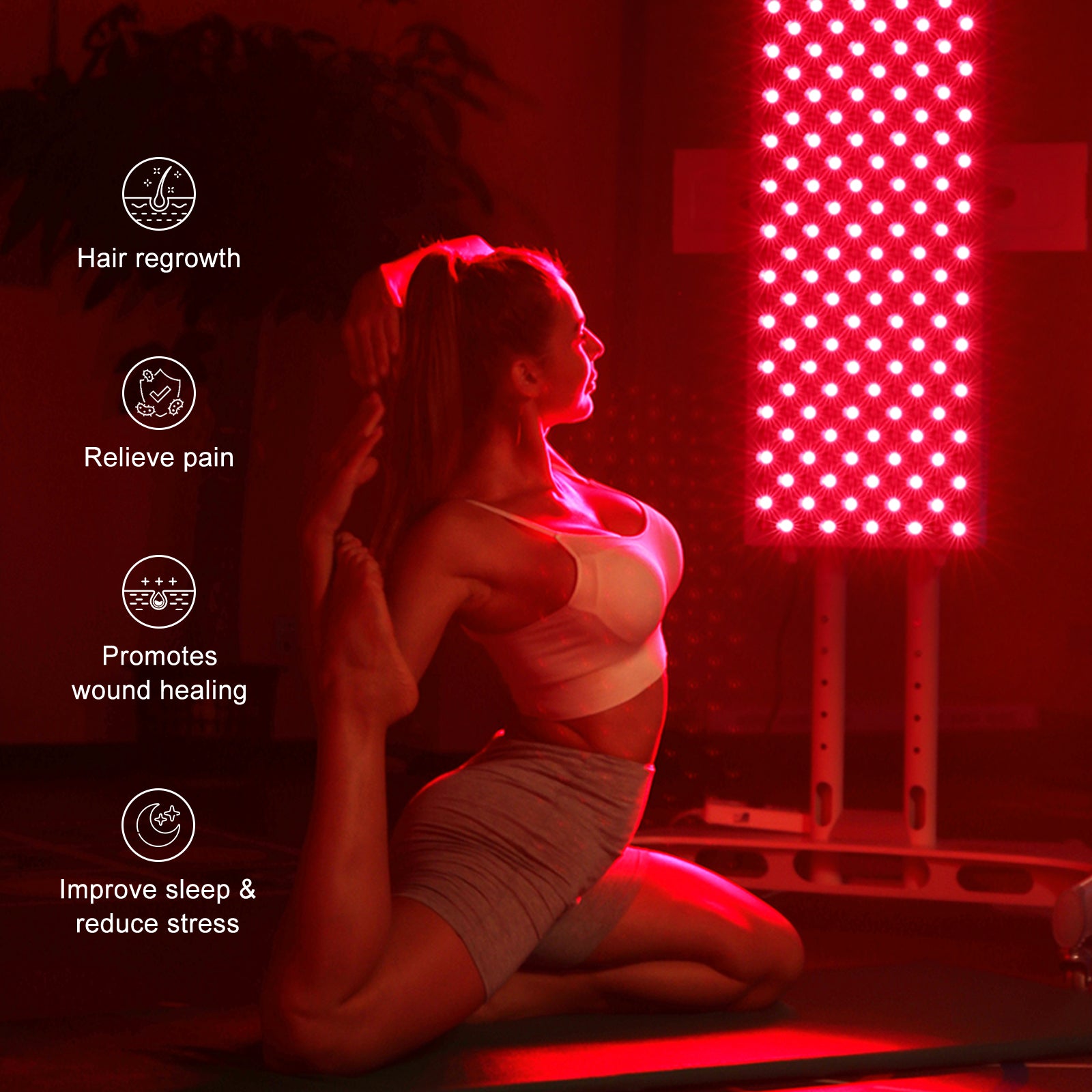

The versatile nature of LED light therapy device makes it popular in the healthcare industry. RLT effectively rejuvenates the skin by increasing the production of collagen. This ultimately leads to the reduction of wrinkles and fine lines and improved skin texture. Apart from providing cosmetic benefits, RLT also plays a crucial role in reducing chronic and acute pain after surgery.

Its effectiveness and benefits further extend to reducing inflammation and faster healing process of the wound. Furthermore, RLT steps into mental health which helps in managing mood disorders, sleep cycle, and other mental problems. Athletes and sportsmen are using RLT for faster recovery from muscle injuries and muscle recovery post-exercise.

Weighing The Benefits And Risks Of Red Light Therapy

The non-invasive and versatile nature of infrared light therapy speaks to its efficiency. For people who are looking for pain-free treatments, RLT is the best option for them. It is one of the safest therapies that rarely has any side effects. However, still one cannot overlook the risks that come from red light therapy. RLT does not show the same and uniform results on all people. People have different skin types and skin conditions that lead to distinct results. Also, there are multiple RLT devices available in the market. Each RLT device comes with different settings and quality, which hinders their safety and effectiveness. Another issue that may cause severe skin damage is exposure to light for a longer time. These concerns demand thorough protection and precautions before using any RLT device.

What Are HSAs And FSAs?

Understanding HSAs And FSAs

The Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) represent financial tools that are specially designed to assist people in managing medical bills and expenses. Both of these accounts provide tax benefits, but they work under different frameworks and rules.

The HSA is only available to the people of the US who pay tax and are admitted to the High-Deductible Health Plan (HDHP). During the deposits, the funds of HSA are not added to federal tax. These funds are specifically saved to pay the qualified medical bills at any time.

FSA refers to a savings account that gives tax benefits to the account owner. Employers establish the FSAs and enable employees to add a small amount of their salary to this account without any tax. This money further is used to clear the medical and hospital bills. FSAs, generally, use the criteria of using it now or losing it later, which means each year your savings will be forfeited.

Key Differences Between HSA And FSA

Both FSAs and HSAs are particularly made for medical and health care bills and expenses but they have some notable differences in them:

1.Eligibility: The HSAs are valid for people who have a salary with a high-deductible plan for health benefits. Whereas, for FAS, you don't need any health plans.

2.Ownership And Portability: HSA is only owned by one person and it will transfer once the person changes his job. On the other hand, FSA is under the employer's name, and people can't get funds transferred after they leave their jobs.

3.Contribution Limits And Rollover: The annual limits of HSAs are higher which will be added in the next year and then next. But FSAs come with lower annual contribution limits with the condition of using it now or leaving it. While some FSA plans permit carryover for a certain amount for a specific time.

To pass the eligibility criteria for HSA, a person must be admitted to a high-deductible wellness plan and he shouldn't be fulfilled by other health plans that are not HDHP. Moreover, people cannot qualify for HSA on other tax return funds.

The employers offering the FSA plan typically decide the eligibility criteria for FSA. It doesn't demand any specific health conditions to become qualified for FSA, which makes it much more accessible and popular among employees. Well, people who have a boss who offers health benefits can only get FSA.

Eligibility Criteria For HSA/FSA Reimbursements

General Criteria For Treatment Eligibility Under HSA/FSA

The HSA and FSA only reimburse the medical treatment or service if the medical expense passes the general criteria of the health expense. The expenses for diagnosis, treatment, prescription, medication, and prevention come in the medical services and bills category. It only includes the expenses of treating health conditions or reducing pain, not cosmetic therapies.

Determining Eligibility Of Health Treatments And Services

The HSA and FSA plans choose health services and treatments to qualify 0by following the guidelines and standards of the IRS. These guidelines comprise eligible medical expenses that pass through medical diagnosis and prescription. Most treatments need further documentation or a Medical Letter (LMN) from a specialist to become qualified for certain health problems.

Red Light Therapy And HSA/FSA Eligibility

Examining Red Light Therapy In the Context Of HSA/FSA Guidelines

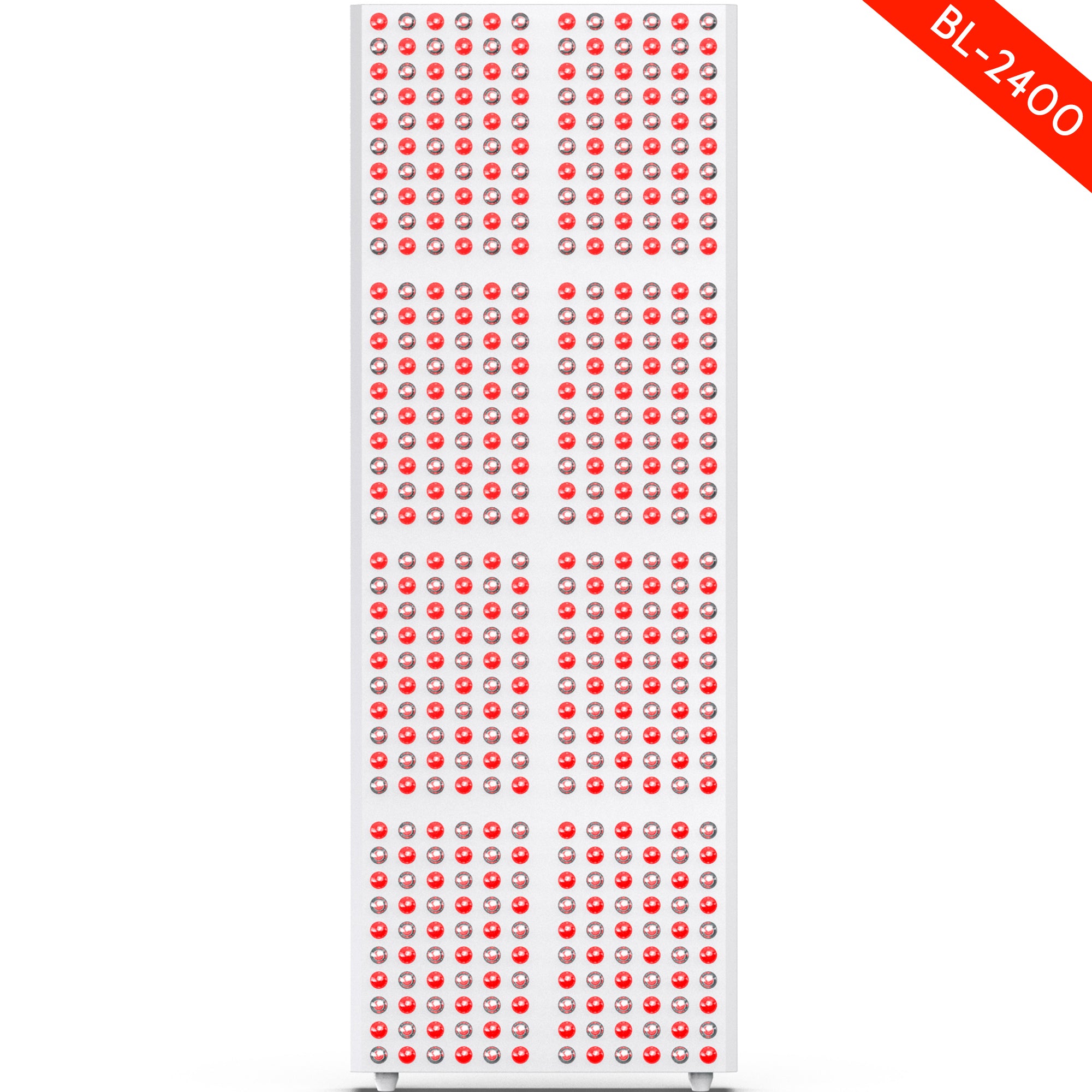

When it comes to considering products like Bontanny that are registered for FDA Class II, LED Light Therapy does not show clear eligibility for HSA and FSA. Enrollment in the FDA increases the credibility of red light therapy devices, which can become a sign of their potential use for health benefits. However, to qualify for reimbursement in FSA and HSA plans still depends on certain health conditions and treatment necessity.

Let's Potential Coverage Under HSA/FSA

The expense coverage of Red Light Therapy mainly depends on whether the therapy is prescribed by a doctor for certain health conditions. For example, if a healthcare provider prescribes you the RLT treatment for curing conditions like skin disorders, wound healing, reducing inflammation, or chronic pain, then it will be eligible for the expenses. But, if a professional LED light therapy machine is used just for cosmetic purposes like anti-aging treatment or skin rejuvenation, then it won't qualify for funds.

Importance Of Documentation And Medical Necessity

Documentation plays a crucial role in considering whether the RLT falls under the FSA/HSA category or not. A healthcare provider letter (LMN) is important to understand the treatment’s need for diagnosis, treatment, and prevention of certain health conditions. Therefore, it would be better to keep all the receipts and records of using RLT, especially for medical treatments. This will help you make RLT eligible for FSA/HSA funds.

How To Determine If Your RLT Is Eligible?

Steps For Confirming Eligibility Of RLT For HSA/FSA

It is important to understand whether LED Light Therapy passes the eligibility criteria for FSA or HSA funds or not. The following steps will guide you through this:

1.Consult The HSA/FSA Guidelines: First, go through the rules and regulations of the FSA or HSA plan. These regulations highlight the types of medical expenses that qualify for funds.

2.Check FDA Regulation: Verify if your RLT device is registered by FDA Class II. The registration plays an important role in determining the medical eligibility of the RLT device.

3.Get A Prescription or Medical Letter: If you get a medical letter or written prescription from a doctor for RLT enhances your chances of becoming eligible for HSA/FSA funds.

Role Of Healthcare Providers in Eligibility Determination

Doctors and physicians play a crucial role in determining the qualification of Red Light Therapy for FSA/HSA. They provide professional evaluation, recommendation, and diagnosis, which are essential in this matter. A physician gives you a medical letter or prescription for the RLT treatment which states why exactly you need this treatment enhances your chances of getting qualified for the reimbursement.

Documentation And Receipts: Keeping Track For Reimbursement

It is important to keep the record and documentation of all red light therapy machine treatments. This documentation may include:

1.Recipes for purchasing an RLT device.

2.A medical letter or prescription from a physician.

3.A complete record of RLT sessions, which also includes the purpose and dates.

If you keep these documents and records organized, they will become one of your best proofs to become eligible for expense reimbursement from HSA or FSA.

Conclusion

In the end, getting to know the fine distinctions of Red Light Therapy (RLT) and its great power for HSA/FSA recompense is crucial in the developing part of treatments regarding healthcare. The basics of LED Red Light Therapy have been covered in this article including dissimilarities, and criteria for the FSA and HSAs. The red light therapy device treatments qualify for reimbursement of these FSA/HSA.

Getting great knowledge about the HSA/FSA for critical moments like RLT is a very important thing for all of the healthcare financial options. If you want some guidance about your specific position at the time it is advised to consult the appropriate financial and health support experts. This step in the process confirms that you are making well-researched decisions accordingly and have your health and finances all set up. Keeping in mind the health and finances while undergoing treatment regarding the LED Red Light Therapy is a must.

Looking for home red light therapy or other red light therapy information? Check out the Bontanny website, where you'll find what you need. Bontanny red light therapy products are FDA Class II registered, and the red lights are trusted by many professional peers

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.